Financing Land Purchase Uk

Sba 7 a loans offer up to 5 million for small business owners.

Financing land purchase uk. Buying land allows you to build the home of your dreams or preserve a slice of nature. While using a farm credit institution is more cost effective than owner financing or leasing to buy it is more costly than purchasing in cash. How do personal loans to buy land work. At pure property finance we know that you want to get the best possible finance solutions with no added hassle.

Find other landowners to talk to for advice and discuss your options with potential lenders. If you do find a lender willing to work with you on your purchase of a raw parcel you may find that your loan will fall under the umbrella of commercial lending in which case you should. Land can be a great asset as it s highly sought after and always on the decline simply because it s impossible to make more. The type of deal you can enjoy will differ between banks depending on a number of factors.

As with any other loan you will need to apply with a lender if you want a personal loan to buy land. Although you might assume that land is a safe investment after all they re not making any more of it lenders see land loans as risky. That s why we work with many lenders across the uk to help you get the finance to buy land or refinance land whatever reason you want it for. Even if you re unable to secure a land mortgage a bridging loan could be a more viable short term option.

Financing a land purchase may be more complicated than the traditional home mortgage process but you shouldn t feel discouraged. As with any other debt you take on you want to get the lowest possible interest rate and the most affordable monthly. A land loan is used to finance the purchase of a tract of land. Another loan through the sba the sba 7 a loan also allows for borrowers to buy land.

It can be difficult for some buyers to come up with. However it may be more difficult to convince the lender to approve your land loan than it would if you were applying for a regular mortgage. Lenders often see land finance as a risky proposition but that can all be changed with a strong application. Buying raw land can be significantly cheaper than buying already improved land but it will be harder to find a lender willing to finance your purchase.

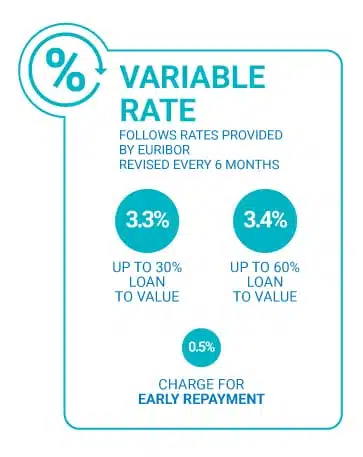

Sba 7 a loans can range up to 25 years in length and can be fixed rate or variable rate. All 7 a loans require a 10 down payment while larger loans above 25 000 also require collateral. However land can be expensive so you may need a loan to fund your land purchase.

:strip_icc()/ways-to-get-money-to-buy-land-4147218_FINAL2-0e2a692104dc4a998e32e60a62371217.png)